In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.Īlso, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. If you opt out, though, you may still receive generic advertising. If you prefer that we do not use this information, you may opt out of online behavioral advertising.

#Chase quickpay zelle Offline#

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Relationship-based ads and online behavioral advertising help us do that. We strive to provide you with information about products and services you might find interesting and useful. So to be ready for the next time you need to send or receive money, just open your Bank of America app So it's important you know and trust whomever you are sending money to, and never use it with people you don't know or to pay for goods and services you have not yet received. Keep in mind, Zelle moves money from your bank account to someone else's in minutes. Millions of people already have it in their bank's app or there's a separate Zelle app that friends can use by enrolling their debit card. Use Zelle to send money for everyday expenses like your share of the rent, gifts, babysitting, or your part of last night's dinner. Money moves in minutes directly between accounts that are already enrolled with Zelle. Due to the high volume of emails we receive, please allow 3-5 business days for a response.Zelle in the Bank of the America app is a fast, safe, and easy way to send and receive money with family and friends who have a bank account in the U.S., all with no fees. If you do not wish us to contact them, please let us know right away, as it will affect our ability to work on your case. As a part of our process in assisting you, it is necessary that we contact the company / agency you are writing about. We assist individuals with consumer-related issues we cannot assist on cases between businesses, or cases involving family law, criminal matters, landlord/tenant disputes, labor issues, or medical issues.

#Chase quickpay zelle free#

Have a question for Michael and the 7 On Your Side team? Fill out the form HERE!ħOYS's consumer hotline is a free consumer mediation service for those in the San Francisco Bay Area. Take a look at more stories and videos by Michael Finney and 7 On Your Side. When we asked Chase about its policy, the bank only offered a warning that bankers will never ask you to send money with Zelle. "I definitely didn't agree and we definitely didn't discuss this outcome," James said.ī of A has refunded some victims of the Zelle scam. What got him most? Chase's denial letter saying: "As we discussed and agreed, no action will be taken. "There's no protection, there's no chargeback, there's no nothing!" James exclaimed. VIDEO: Bank of America gives refunds to some victims of growing Zelle scamīut Chase told James he authorized those payments - even if it was a scam. "Their attitude is, if it's on Zelle, shame on you," James said.įederal law requires banks to refund victims of fraudulent, unauthorized money transfers. and like B of A's initial response to customers, Chase denied James's fraud claim. It was the same con that hit B of A customers across the country. "At that point I went, 'Hey I'm not talking to the bank. When one transaction went awry, the scammers got angry.

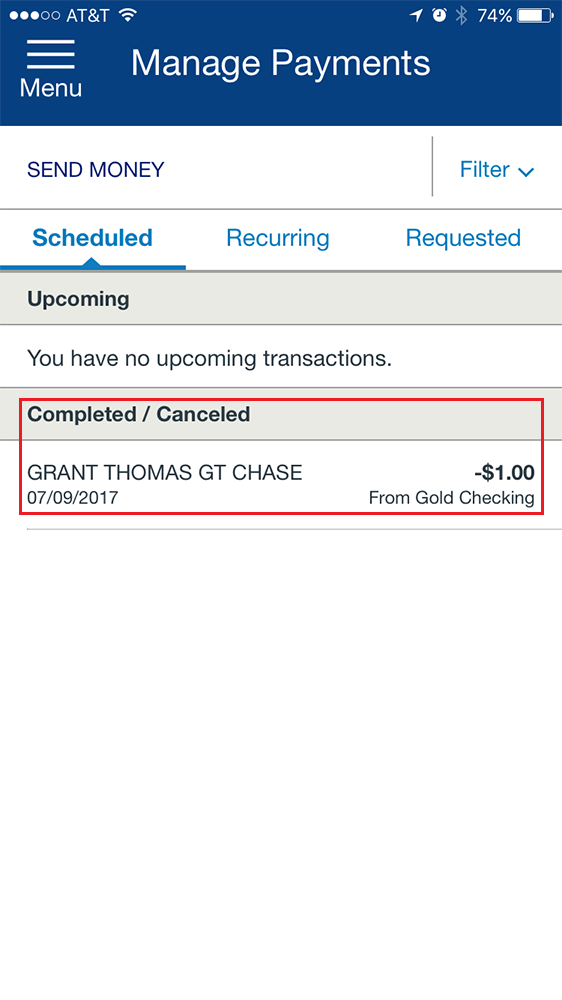

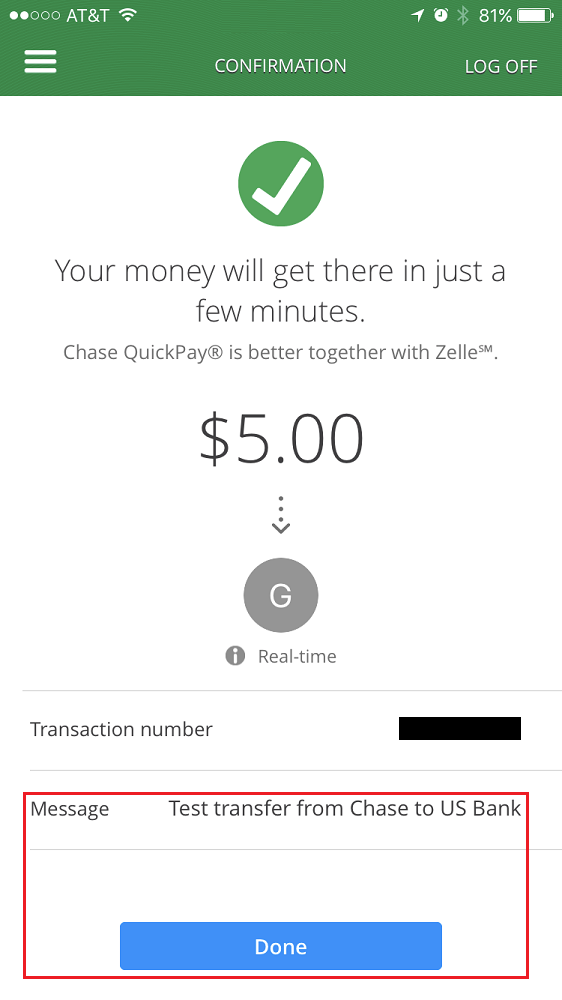

"To the tune of $7,000 over several transactions," he said. and the imposters snatched the money at the other end. "So I was getting notifications on my phone that I had sent myself money," James said. It seemed like it was going back to James. The imposter told him to transfer the money with Zelle using his own phone number.

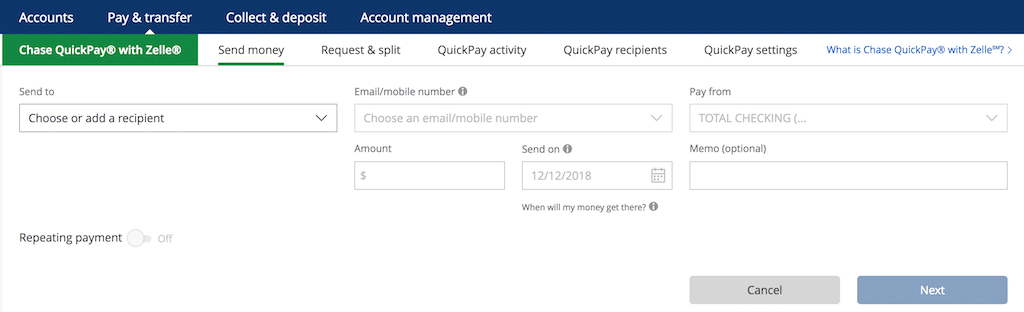

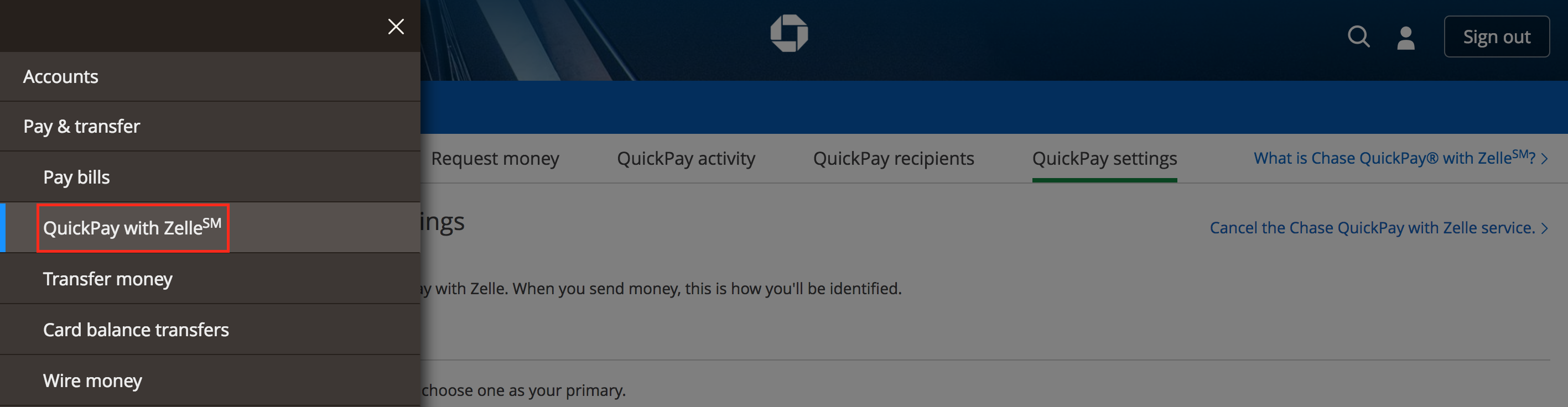

#Chase quickpay zelle how to#

RELATED: More victims of Bank of America, Zelle scams come forward here's how to protect yourself

did you send a Zelle for $2,000?' I'm like, 'No,' and he says, 'We need to send the money back to yourself,'" James explained. "And he goes, 'Let's go over these charges. "The caller ID number was identical to the one on the back of my Chase card," he said. Or at least he thought it was the Chase Bank fraud department. VIDEO: San Francisco man loses half his savings in bank transfer scam And it was Brian from the Chase bank fraud department," he continued. "'If not, reply, no.' I said, 'No.' And my phone rang.

0 kommentar(er)

0 kommentar(er)